The winners of the National NMT Nursery Awards reflect on what their achievement means to them

Business outlook: the year to come

Following the launch of Christie & Co’s Business Outlook report, Nick Brown, head of brokerage – childcare & education at Christie & Co, shares a deep-dive analysis of the UK children’s day nursery market in 2024 and his expectations for the market this year

Market overview

2024 was a really active year for children’s day nursery transactions across the UK, with major deals including the sale of Pippa Pop-ins Nursery Schools in London, Kingfisher Day Nurseries in Derbyshire, Muddy Boots Childcare in Devon, Tiptoes Nursery Group in East Yorkshire, and the largest independently owned nursery group of 24 settings, Children 1st Day Nurseries.

We saw an increase in appetite from medium groups: this buyer category acquired 5% of all day nursery transactions in 2023, which rose to 19% in 2024. Conversely, compared with the prior year, 2024 saw a decrease in appetite from smaller groups, single settings and first-time buyers, with these buyers acquiring just 15% of assets in 2024 compared with 33% in 2023.

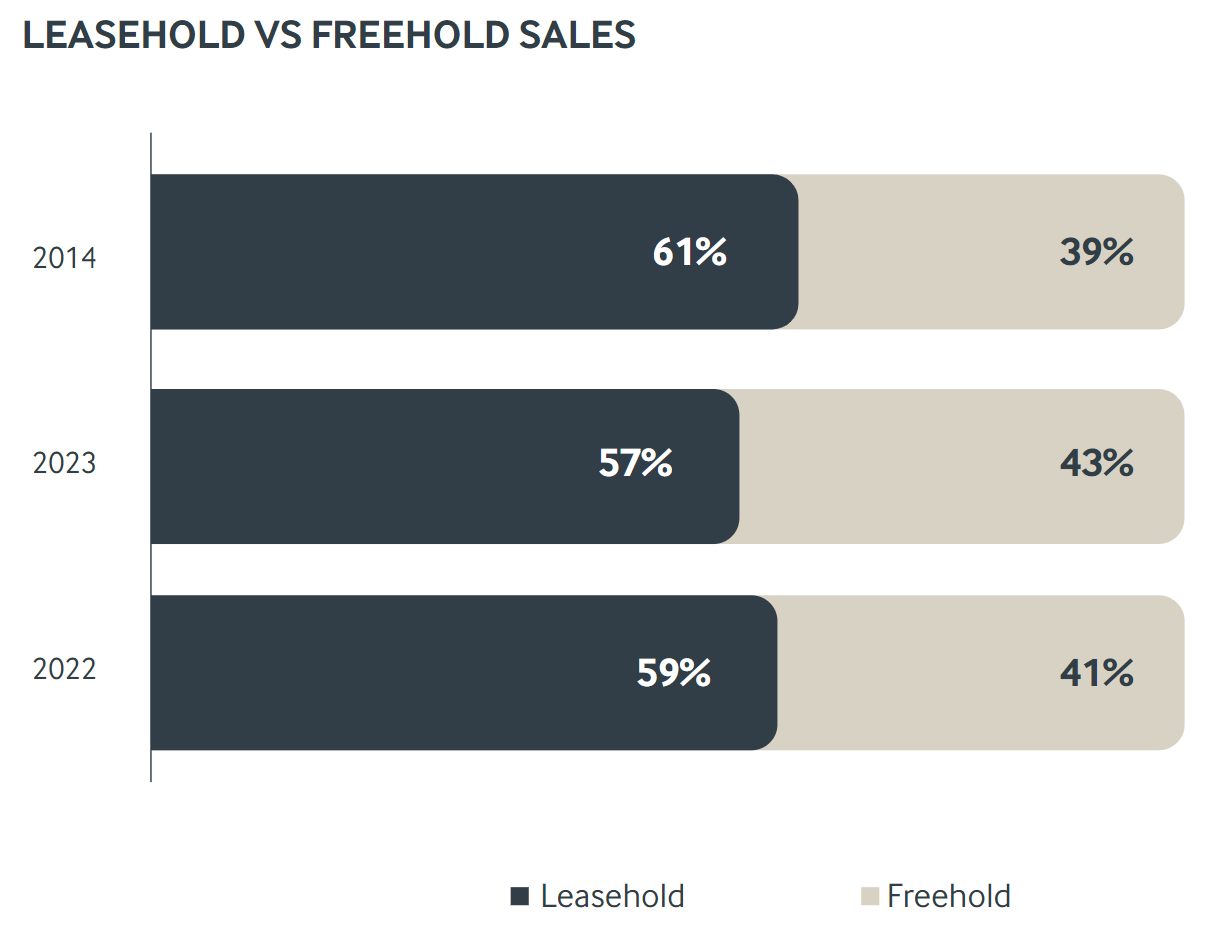

Buyers remained keen to acquire both leasehold and freehold opportunities, although there remains a lean towards leasehold sales, with 61% of day nurseries sold in 2024 being leasehold compared with 57% in 2023 and 59% in 2022. There are several factors driving this trend. Leasehold provides a lower entry point for buyers as there is no real estate to pay for, so it is often seen as a more affordable option.

Meanwhile, many owners see the advantage of holding onto their properties and creating a lease with a rent which provides an excellent return on investment as well as the flexibility to sell the property later. Additionally, some of the larger acquirers in the market have been just as happy to buy without the backstop of an asset as long as the lease on offer is commercial and secure and of a decent length to provide them with the security of tenure.

Corporate and large groups acquired smaller settings last year, with the average having 86 places compared with 92 places in 2023. Smaller groups acquired larger settings, with the average changing from a 62-place nursery to a 67-place nursery, while there was little change in the settings acquired by independents and first-time buyers.

There was positive news on the cost of borrowing front last year, with inflation beginning to settle close to the Bank of England’s target of 2%, and interest rates have been falling in line with this. The cost of borrowing has a direct effect on the affordability for buyers looking to consolidate and expand.

A shift in geographies

Where previously there was a notable concentration of buyers seeking settings in London and the Southeast, activity in 2024 stretched across all areas of the UK. Given the high levels of competitive tension, buyers began to seek nurseries in alternative areas, looking for value for money. These other areas offered the opportunity to acquire nurseries that would generate a similar amount of EBITDA (earnings before interest, taxes, depreciation, and amortization) but sometimes with lower overheads and the potential for any property deal to be more balanced in terms of value against prices than those which were being seen, for example, in London.

Once deals were completed in other major cities across the county, more and more buyers became aware that this was a good route to explore. We are now seeing activity right across the UK and buyers are increasingly looking for the next location to invest in.

As Covid-19 changed the demographic in terms of commuting parents and childcare requirements, more rural nurseries are beginning to really flourish and see occupancy growth.

Most active buyers who are keen to acquire a foothold in a certain area need some form of scale to be able to enter a new territory. Buying a small group is an ideal solution to this and provides a platform for further expansion. Alternatively, if the provision in a specific area is fragmented then buyers may also consider buying the best nursery in that location, with a plan already in place to acquire other settings in a short space of time building this into a cluster. This is one of the ways we have seen operators continue to consolidate and expand into new territories.

Investor appetite

From an investment perspective, interest in the UK day nursery market in 2024 was fuelled not only by the extended early years entitlement and increased government-backed income in the sector, but also by a shift in investors focusing on social impact investment opportunities, ethical investing, and environmental, social and governance (ESG) considerations.

The past 12 months saw a notable increase in medium-sized groups making selective acquisitions to expand their regional footprints. There was also no shortage in demand from investors and buyers seeking platform acquisitions and opportunities to consolidate via the acquisition of high-quality, larger capacity settings within the UK’s children’s day nursery sector.

Challenges

Despite a buoyant marketplace, the sector continues to face challenges that impact day nursery owners and their decisions to sell or acquire. In summer 2024, having won the general election, the Labour government began implementing some of the pledges in its manifesto. For childcare, this meant creating 3,000 new nursery classes across England, with a pilot scheme initially launched for 300 state nurseries to be operational by September 2025.

Ahead of the autumn budget, October proved to be an unprecedented month for completions at Christie & Co, as owners progressed sales processes endeavouring to close deals ahead of the announced policy and tax changes. This led to a surge in business owners deciding to sell. The budget announcement that followed saw rises in Capital Gains Tax (CGT), National Insurance Contributions (NICs) and National Living Wage (NLW) which will, no doubt, impact day nursery owners across the country.

Pricing

The average price of day nurseries we sold in 2024 increased by 7.7% compared with 2023. The quality of provision transacted in 2024 was notably stronger than in 2023, with high volumes of investment-grade transactions completed. The average price of medium group portfolio sales increased by over 10%, while small group, single settings sales were flatter in pricing terms reflecting a tone in the order of one per cent pricing increase.

The comparative premiums paid for portfolios, linked to the configuration, quality and nature of assets, alongside the type of buyer and their desires to acquire multiple nurseries in a single transaction, may influence this increase in medium group prices. However single asset settings remain in high demand and exceptional prices have continued to be achieved for those of high-quality in desirable locations.

Market sentiment

As part of our annual sentiment survey, we asked childcare and education professionals across the country for their views on the year ahead. When questioned about their sentiment in 2025, 29% said they feel positive, and 31% feel negative, while the majority (40%) remain neutral, which illustrates the uncertainty in the sector. When asked about their sale and acquisition plans, 62% stated that they are looking to buy and/or sell this year.

Predictions for 2025

In the day nursery market in 2025, we expect to see:

- Continued interest in platform acquisitions, expansion and growth opportunities from entrants, established and new

- High demand for quality leasehold and freehold opportunities across the UK

- Further consolidation from large- and medium-sized groups seeking acquisition opportunities

- Buyers will increasingly scrutinise parental demographics when considering acquisitions and undertaking due diligence

- With the 2025-26 Early Years Pupil Premium funding rates not factoring in NIC increases, some settings will face greater financial sustainability challenges.

Latest Features

Stephanie Mensah, co-founder of Bibinee Dolls, explores the importance of diversity in early years education and asks if we are…

We find out how Chalk Nursery Group worked with managed technologies firm Active8 to make life easier for its nursery…