The winners of the National NMT Nursery Awards reflect on what their achievement means to them

Business Outlook 2023: The old year and the new

Today, Christie & Co launched its Business Outlook 2023: Finding Clarity report which reflects on the themes, activity and challenges of 2022 and forecasts what 2023 might bring across the industries in which Christie & Co operates in, including the day nursery sector.

Following a period of stagnated activity in 2021, due largely to the pandemic, it was clear from the start of 2022 that confidence and growth appetite had been regained, explains Courteney Donaldson, managing director, childcare & education at Christie and Co

Drivers that fuelled buyer appetite last year included the post-Covid-19 ‘catch-up’ hunger to grow earnings and market share via consolidation, teamed with an increase in opportunities coming to the market. The children’s day nursery market experienced a great degree of heightened activity, with quality early years businesses, especially small- to medium-sized regional groups, being highly sought-after which resulted in bidding wars fuelled by intense buyer demand.

That said, not all childcare and education markets have returned to pre-pandemic levels, with many businesses continuing to face a host of operational challenges. In 2022, while some businesses were sold for eye-watering prices, others were unable to keep their heads above water due to financial, workforce, and capacity issues which resulted in an increase in business closures.

We saw a widening gap between businesses doing well and businesses struggling, and an increase in businesses just ‘getting by’, especially within the early years sector where trading performances have been heavily influenced by local demographics and capacity limitations alongside other micro and macro factors.

International market activity

2022 saw some very notable activity with trade buyers across different continents acquiring high-quality early childhood education and care (ECEC) platforms in new territories.

Transactions included the merger of Sodexo’s childcare services business with Grandir. Having entered the early years childcare market with its acquisition of Creche Attitude in 2010, Sodexo built and grew the early years childcare portfolio, Liveli, which saw successful expansion into Germany via Elly & Stoffl, Spain and India. With Liveli providing 300 ECEC centres, revenues in the order of €146 million and 3,500 staff, this was one of the most notable ECEC European transactions of Q1.

In May, Bright Horizons announced its acquisition of Only About Children. With revenues of A$197 million, the portfolio of 75 ECEC centres in New South Wales, Victoria and Queensland, was sold By Bain Capital for A$450 million.

Investment activity also gained momentum when Canadian private equity firm, Onex, sold its majority stake in the largest childcare provider in the Netherlands, Partou, to former minority shareholder, Waterland Private Equity Investments. Just four months later, Partou acquired UK nursery group All About Children, which marks the provider’s second UK deal since its acquisition of Just Childcare in 2021.

Other global ECEC transactions included the sale of Just Kidz Group, a portfolio of 13 centres in Singapore, sold to Busy Bees for 62.3 million Singapore dollars, China New City Commercial Development’s sale of London-located Maggie and Rose nurseries to Grandir, and UK-headquartered Dukes Education’s first international acquisition of United Lisbon International School, providing early childhood education and care from three years through to graduation.

For investors, trade buyers, and those successfully completing the sales of their international portfolios, 2022 was a landmark year. We anticipate further consolidation opportunities to emerge in 2023, with premiums remaining strong for the most desirable portfolios, and a very busy international marketplace, with significant mergers and acquisition activity.

UK market activity

Despite multiple challenges, 2022 was an exceptional year for day nursery transactions. One of the most significant in the market being the sale of All About Children, which comprised 38 settings and around 3,000 places largely based in London, the Southeast and the Midlands. The business was sold to Partou in a multimillion-pound deal backed by Waterland Private Equity Investments.

Throughout 2022, we saw a huge amount of interest for a range of day nurseries across the UK from a pool of well-funded buyers. This can be seen in our deals throughout the year, including the sale of the six-setting Twinkles Nursery Group in Yorkshire to Kids Planet, Creative Flair Childcare in Warwickshire to newly established group Growing Stars Childcare, and 11-strong Cherry Childcare Day Nursery & Pre-school based in the South of England which sold to Family First.

Appetite remained strong for both freehold and leasehold opportunities, although we saw a shift in trend towards sellers choosing to retain their freehold properties and just selling the business in isolation, thus providing an annual income as well as a lump sum premium.

Impressive prices continued to be achieved for the most desirable nurseries with robust and up-to-date information, for both single assets and portfolios in sought-after cities and regional hubs, including London, the Midlands and the Southeast, as well as Leeds, Greater Manchester, Bristol, Glasgow and Edinburgh.

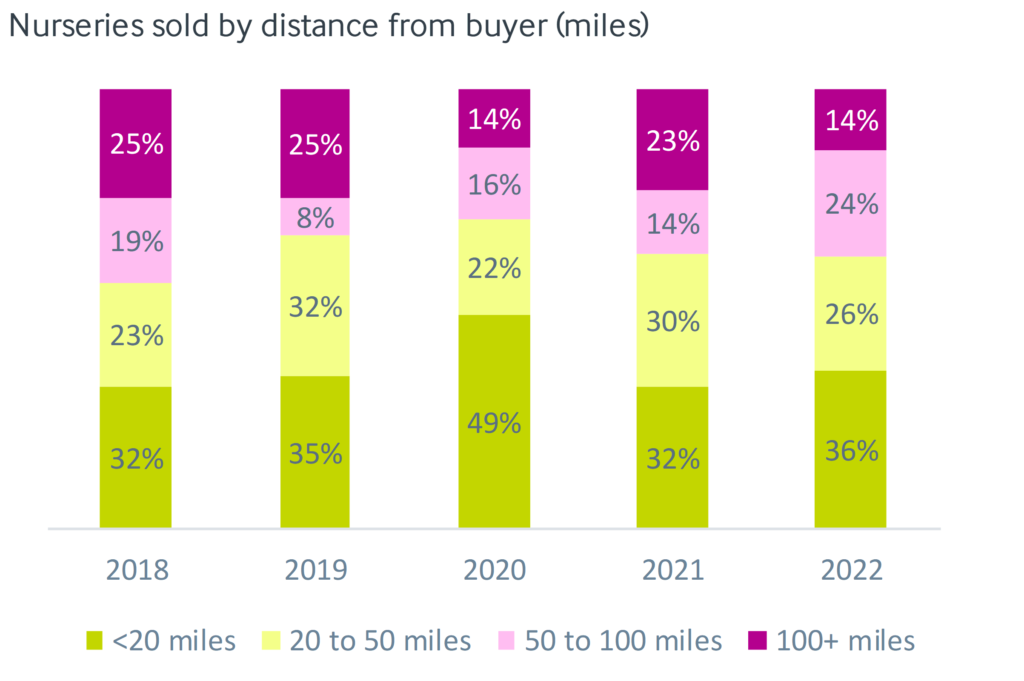

While, in 2021, buyers were mostly acquiring settings close to home, in 2022, they looked further afield, with the majority (62%) buying within 50 miles of their current operation/residences, and approximately a third buying within 30 miles of existing hubs. Those purchasing settings more than 50 miles away increasingly represent corporates or groups with a national presence.

2022 was a record year in terms of volume and value of offers received. Offers accepted sat at an average of 17% over asking price which illustrates acute competitive market tension between buyers to secure the most desirable nurseries and gain ‘quality’ market share.

NMT also spoke with Nick Brown, director and head of brokerage – Childcare & Education at Christie & Co.

“2022 has been a very busy year, with appetite right across the buying spectrum, from first-time buyers to regional operators, to the larger national groups. The competitive tension we have been able to create in deals which we have been involved in has resulted in market-setting prices being achieved and activity in areas of the country which have previously not been seen as hotspots. We are optimistic about 2023 and hope to see similar trends and activity for quality nurseries across the country.”

Your top positive takeaway/s from the business outlook?

The volume of childcare and education deals completed and the value and volume of offers received reached unprecedented highs last year, and offers accepted sat at an average of 17% over asking price which shows the competition in the market and the appetite that remains from buyers for these good-quality settings.

Buyers are looking further afield for their next purchase, as well, which has opened up certain areas that were, previously, not really considered hot spots, which is a real plus for those wanting to sell both from an interest and a price perspective.

All of this shows just how robust the market is. Despite the raft of challenges in the day nursery sector, it’s still a really appealing sector to be part of and to buy into, and operators and prospective operators can see that.

With living wage increasing, changes to business rates and the energy support for businesses stopping in April, do you have concerns for further financial disruption?

The sector continues to face a raft of challenges – from workforce issues to the rising cost of living, etc. – and these are impacting everyone, right across the country.

We know that more changes, and perhaps further challenges for operators across the board, are coming, and so those in the sector are, no doubt, striving to prepare for that as much as they can. But, given the resilience of the sector and its workers, we remain cautiously optimistic, fully aware that we won’t really know what lies ahead in this respect until we’re in it.

What we can say, however, is that this isn’t dampening demand for settings at the moment.

In your sentiment survey, looking to buy pulled ahead, is this for all sizes of nursery businesses or more consolidation across the leading groups?

We’re seeing acquisition activity from a real range of operators for all sorts of day nursery businesses; from new market entrants to those owning single sites, to larger, multi-site operators.

However, the challenge for new entrants and those less experienced operators, really, is sourcing funding. That’s not to say that it can’t be obtained, of course, but there are more hurdles for these types of buyers, but that’s long been the case.

Business Outlook 2023: Predictions for year ahead

For our annual ‘Business outlook’ report, we surveyed childcare and education business operators from across the UK to gather their views on the year ahead.

Results revealed a balanced sentiment from operators, with a third (33%) saying they feel positive about the year ahead, and just under a third (32%) expressing nervousness/negativity, which isn’t at all surprising given the turbulence that business owners have endured over the past year. That being said, 38% of operators said that they are looking to buy in 2023, so we’re sure to see another competitive marketplace in 2023 and beyond.

Business Outlook 2023 – We also expect:

- The market will continue to be resilient in terms of quality and offering against external challenges and pressures

- Premium childcare settings will remain highly sought-after by buyers, commanding premium prices

- All locations will be considered by buyers as they expand out of London and the Southeast

- We will continue to see regional consolidation as operators strive to protect their portfolios/footprints

- Expanding private equity-backed groups will show signs of further growth over the coming years

- Despite a likely increase in ‘distressed’ businesses coming to the market, buyers will continue to react with pace when quality childcare and education businesses, whether single assets or groups, come to market

- We anticipate continued consolidation between national and regional day nursery groups.

To find out more about the current day nursery market, read Christie & Co’s ‘Business Outlook 2023’ report which is available from 19 January: christie.com/news-resources/business-outlook/

Latest Features

Stephanie Mensah, co-founder of Bibinee Dolls, explores the importance of diversity in early years education and asks if we are…

We find out how Chalk Nursery Group worked with managed technologies firm Active8 to make life easier for its nursery…