We chat to outdoor play expert Claire from Creative Play, who shares how imaginative play can support early years development…

5 ways to recession-proof your nursery

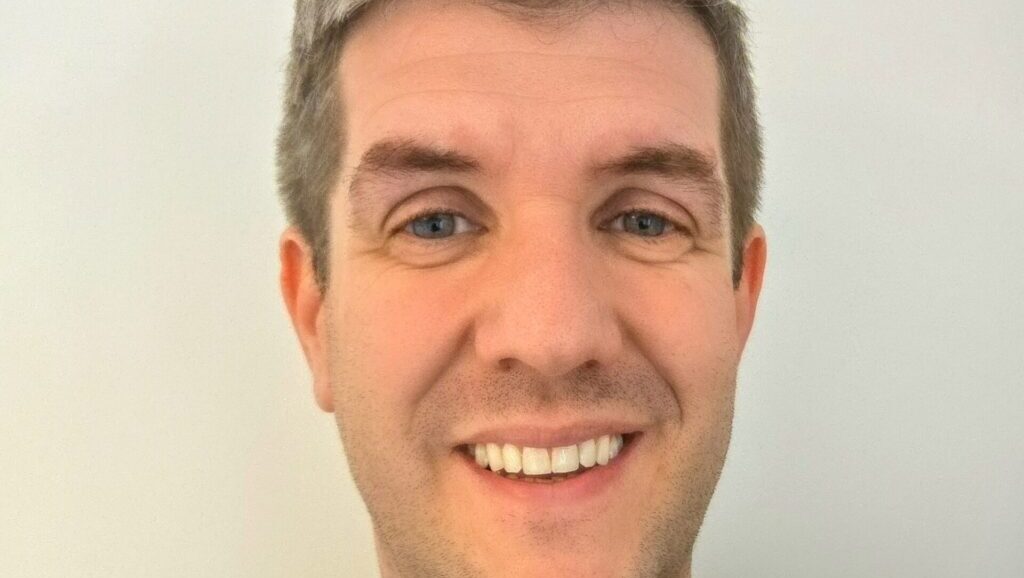

Kush Birdi, managing partner of Birdi & Co Solicitors, explains 5 ways to recession-proof your nursery business

The childcare sector – like most sectors – was hugely affected by the Covid-19 pandemic, but we’ve recently seen a return towards fairly normal times. The M&A market continues to be buoyant with interest from competing buyers as strong as ever.

However, inflation has become one of the main concerns for the global economy and we’re seeing a 40-year high in the cost of living. Nursery owners should keep a close eye on the current situation as the gap between fee income and business overheads may narrow somewhat – especially in light of increasing staff costs.

The good news is that demand for childcare is likely to remain high even if a recession is on the horizon, but nursery owners should still put themselves to the challenge of recession-proofing their nursery business.

Here are 5 ways to recession-proof your nursery business:

Review your financial status

It may sound obvious, but a good place to start is to review your current income and

expenses. With prices going up across the board, it’s wise to see where costs can be reduced so shop smarter where possible. You should also review your rates and consider an increase where appropriate.

For example, if you haven’t reviewed your rates for several years then an increase could be warranted. If you decide to increase your rates, then how and when to inform parents will be questions to consider carefully.

Building an emergency fund is a must! Not only will this give you peace of mind and help you sleep at night, but you will have increased confidence in your business model (and with a planned rate increase should that be on the agenda).

Finally, an accurate set of management accounts will allow you to keep on top of all the above in a readily accessible form.

Invest in the right technology

Investing in technology is a great idea because it allows businesses (and its staff ) to run more efficiently and productively than before. This has many advantages such as increased staff motivation, lower costs of service and therefore higher profit margins.

Imagine if you and your staff members could complete tasks within a fraction of the usual time. You could focus on the more important tasks including things that will grow your business even further.

Technology such as computers, tablets, smartphones are a part of everyday society and, subject to appropriate controls and safeguards, can offer an enhanced digital experience for children that are inevitably going to grow up in a modern digital era. Technology is here to stay and should be embraced in the appropriate environments.

The right technology will save your business money and time, and could put you ahead of your competitors allowing you to command higher rates – especially in the most affluent locations.

Examples of the effective use of technology are:

• Nursery management software

• Accounting software package

• Screen-based devices (such as interactive whiteboards or apps) to encourage creativity and activity of children

• Digital-translation to help children learn more languages.

Incentivise your staff

Common ways to incentivise staff members include professional development and training, bonuses and salary reviews, gifts, events, staff discounts, health and wellness initiatives and more.

However, employee share schemes are on the rise and have been for the past decade, at least, and are a proven way to attract and retain the best talent and to generally increase employee engagement and performance.

An employee share scheme is a way to give employees a stake in your business, by giving them an option to acquire shares after a certain period of time, on the achievement of specific milestones or on a triggering event such as a sale of the business.

Tax-advantaged share schemes such as the Enterprise Management Incentive (EMI) scheme and Company Share Option Plan (CSOP) offer significant tax benefits and, therefore, make for excellent

staff incentives.

In general, share options are commonly preferred over giving shares out directly because, provided they are structured correctly, the employee pays no tax when the options are given and only when the option is exercised.

Often the shares are sold immediately after the option is exercised which provides the employee with the necessary funds to pay for the shares and to keep the profit element. There are other tax advantages too including corporation tax reliefs for the company.

The lesser-known Employee Ownership Trust (EOT) is also becoming a popular option for shareholders and provides an opportunity for every employee to share in the profits of the business. When structured correctly, EOT structure will not attract any capital gains tax for shareholders on their sale.

It’s self-evident that employee share incentives are a powerful tool in driving significant growth and success for your nursery. The importance of working with suitable advisors cannot be understated, and it is highly recommended that you appoint specialist legal advisors (such as Birdi & Co).

Get a business health check

After the painful experience of lockdown and Covid-19, we’re seemingly entering another phase of economic and political uncertainty (putting it lightly). Now is a better time than any to review key components of your business to check that you are keeping up-to-speed.

A business health check conducted by a solicitor will help you to understand where risks and, therefore, potential liabilities may lie in your business. You will then have the opportunity to “get in shape” and have peace of mind prior to any recessionary effects taking place. Undergoing a business health check will involve an audit of areas like:

- Reviewing your terms and conditions to check that they remain compliant and up-to-date

- Implementing the partnership or shareholders’ agreement that you have been meaning to get done, or to review the existing one to check it remains fit-for-purpose

- Reviewing your GDPR / privacy documents to check that they remain compliant

- Checking the employment contracts and handbook / policies for relevant updates

- Monitoring your lease (if leasehold) to check that your business is protected in all economic situations, or advising on options for moving premises should that become a necessity in the future.

Review your corporate structure

Are you holding your freehold or leasehold premises in the same structure as your nursery business? It may be prudent to separate them out to protect one from the other in the case of unforeseen financial circumstances. For example, if your nursery business is hit with a big claim which is not insured against, your premises may be at risk.

Alternatively, if you’re operating as a sole trader or unincorporated partnership, there may be advantages in converting your business structure into a limited company set up. There are a number of ways to re-structure your business in a way that mitigates the risks presented to your nursery business and its assets, and to shelter the profits earned over the years.

As always, it is important to work with specialist advisors who can confidently advise on your range of options and be clear about the implications of your chosen business structure.

I hope this article has answered some of your questions about how to recession proof your nursery business. If you would like us to cover a specific topic in the next edition, please reach out to let me know – I will be delighted to hear from you.

Contact us

Please contact me if you would like a confidential chat about your business:

Kush Birdi, managing partner, Birdi & Co Solicitors

(w): www.birdilaw.com

(t): 07745 525 837

(e): [email protected]

Let’s connect on LinkedIn:

@BirdiandCoSolicitors

@KushBirdi

Latest Features

The roll-out of new innovations doesn't always go to plan. Ben Case, education advisor at childhood education platform Tapestry, sets…

We discover how RafaKidz Medmenham transformed its outdoor space